Contents:

Browse an unrivalled https://1investing.in/ of real-time and historical market data and insights from worldwide sources and experts. Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers.

As a data and analytics company, VettaFi is aware what ETF topics are of greatest interest to investors, based on more than two million unique monthly visits to the VettaFi platform. To see all exchange delays and terms of use, please see disclaimer. According to Tudal, the Vanguard FTSE Emerging Markets ETF etf price forecast for 2033 Apr. According to Tudal, the Vanguard FTSE Emerging Markets ETF etf price forecast for 2032 Apr. According to Tudal, the Vanguard FTSE Emerging Markets ETF etf price forecast for 2028 Apr. According to Tudal, the Vanguard FTSE Emerging Markets ETF etf price forecast for 2027 Apr.

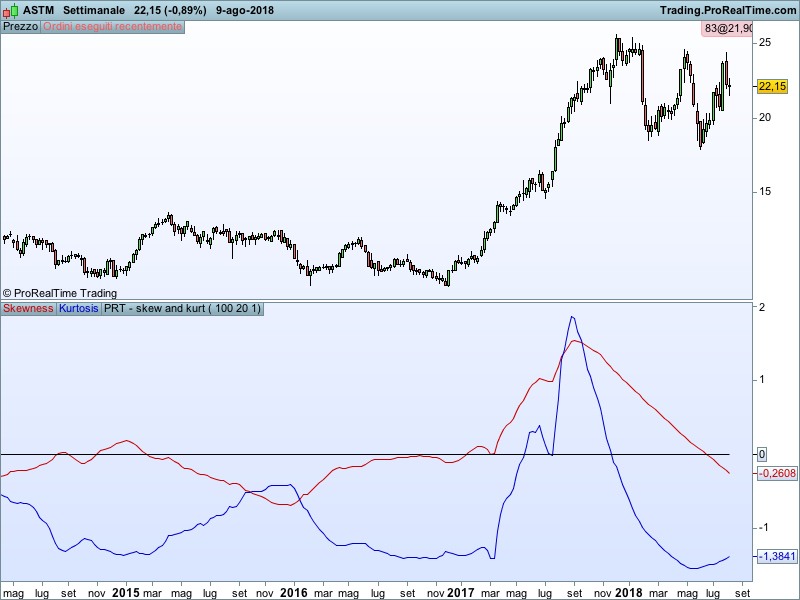

For example, a price above its moving average is generally considered an upward trend or a buy. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Our calculations are based on comprehensive, delayed quotes. The adjacent table shows a Realtime Rating for several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating.

Alibaba’s Delisting Risk Proves Too Much for Ray Dalio — GuruFocus.com

Alibaba’s Delisting Risk Proves Too Much for Ray Dalio.

Posted: Mon, 15 Aug 2022 07:00:00 GMT [source]

Vanguard International Equity Index Funds — Vanguard FTSE Emerging Markets ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. It invests in public equity markets of global emerging region. It invests in stocks of companies operating across diversified sectors. It invests in growth and value stocks of companies across diversified market capitalization.

VWO Overview

News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. By David Randall and Rodrigo Campos NEW YORK — The steep decline in emerging market stocks since early this year are attracting some U.S. fund managers who think they… VWO Emerging Markets WeakeningWith the dollar gaining some strength up above 92 and rates raising to 1.6% in the US 10 yr emerging markets have started weakening.

© 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. During a recent ETF Trends webcast focused on emerging markets, 42% of advisor respondents said that they allocate between 5% and 10% of client assets to emerging markets, and an additional 11% report… You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

Notes & Data Providers

Percent of Float Total short positions relative to the number of shares available to trade. In the VWO review, we covered VWO key stats , buy and sell analysis, and alternative investments. If this review was helpful to you, feel free to check out other mutual fund and ETF reviews. Share price information may be rounded up/down and therefore not entirely accurate.

- Vanguard Emerging Markets Stock Index’s broad portfolio and rock-bottom expense ratio should help it perform well over the long haul.

- We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes.

- No matter what the market conditions are, the hottest ETFs to buy will almost always make sense for investors.

Vanguard Group, Inc. — Vanguard FTSE Emerging Markets ETF 52 week high is $46.45 as of April 10, 2023. Expense ratio updated annually from fund’s year-end report. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Get our overall rating based on a fundamental assessment of the pillars below. Here is a look at ETFs that currently offer attractive short selling opportunities.

Is Schwab Fundamental Emerging Markets Large Company Index ETF (FNDE) a Strong ETF Right Now?

I have read and understand the terms and disclaimers related to the program. You can buy Vanguard FTSE Emerging Markets ETF shares by opening an account at a top tier brokerage firm, such as TD Ameritrade or tastyworks. Yes, Vanguard FTSE Emerging Markets ETF is a publicly traded company. Market data is delayed by 15 minutes and provided by NYSE, NASDAQ, AMEX, and ARCX .

IShares has lowered the expense ratios on several popular funds in a move that makes its already low-cost ETFs even more accessible to investors. While U.S. equities remain top of mind for advisors, emerging equity markets are in greater focus than all other asset classes. In a tumultuous year for both domestic and international stocks, China has faced a number of unique challenges, both from internal COVID regulations as well as external political tensions with the U.S… Vanguard crossed the $2 trillion mark in U.S.-listed ETF assets under management this week, aided by $23 billion of net inflows to start the year and positive year-to-date total returns for nearly all…

Bull vs. Bear: An Indian Century in India Equities ETFs?

International stocks are broadly outperforming this quarter, decoupling from the U.S. to an unusual extent, according to DataTrek Research. We have 5 different ratings for every ETF to help you appreciate its future potential. Our quantitative analysis shows 3 reasons to buy and 3 reasons to sell it, resulting in the Finny Score of 50.

Sign Up NowGet this delivered to your inbox, and more info about our products and services. If you aren’t doing this a couple times a week, you need to start. Grab your salt and pour some directly down your drain at night. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Verify your identity, personalize the content you receive, or create and administer your account.

We’d like to share more about how we work and what drives our day-to-day business. The Parent Pillar is our rating of VWO’s parent organization’s priorities and whether they’re in line with investors’ interests. The People Pillar is our evaluation of the VWO management team’s experience and ability. We find that high-quality management teams deliver superior performance relative to their benchmarks and/or peers.

It’s calculated by averaging the closing stock price over the previous 50 trading days. Vanguard Group, Inc. — Vanguard FTSE Emerging Markets ETF 50-day moving average is $40.44. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

understanding deferred revenue vs. accrued expense returns and principal value will fluctuate and are subject to market volatility. An investment, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. ETF Database analysts have a combined 50 years in the ETF and Financial markets, covering every asset class and investment style. The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios.

The «A+ Metric Rated ETF» field, available to ETF Database Pro members, highlights the best rated ETF in the Emerging Markets Equities category for each metric. To view information on how the ETF Database Realtime Ratings work, click here. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. Emerging market exchange traded funds have been battered this year as the prospects of higher interest rates in the U.S., slowing growth in China, and a strong dollar weighed on developing economies. No matter what the market conditions are, the hottest ETFs to buy will almost always make sense for investors.

Provide specific products and services to you, such as portfolio management or data aggregation. Information is provided ‘as is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. Repair and recovery were on display last week as the major asset classes clawed back some of the across-the-board losses in February.

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more. Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. The Vanguard FTSE Emerging Markets ETF seeks to track the performance of the FTSE Emerging Markets All Cap China A Inclusion Index.

- To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

- Before going into the macro analysis, whats the market allocation of this ETF.

- Find exchange traded funds whose sector aligns with the same commodity grouping as the symbol you are viewing.

- By David Randall and Rodrigo Campos NEW YORK — The steep decline in emerging market stocks since early this year are attracting some U.S. fund managers who think they…

Emerging market ETF investing is currently in a tight spot due to the dollar strength, rising rates in the United States, capital outflows, a slump in China’s economy, rising inflation and a deba… With CNBC’s Sara Eisen and the Fast Money traders, Courtney Garcia, Tim Seymour, Steve Grasso and Jeff Mills. Sector and region weightings are calculated using only long position holdings of the portfolio.

The following charts reflect the allocation of VWO’s underlying holdings. The following charts reflect the geographic spread of VWO’s underlying holdings. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. Vanguard Emerging Markets Stock Index Fund’s management fee is 0.06% and has other expenses of 0.02%.